Succession Planning: How to have the “Talk” with your family about it

The topic of Succession Planning often requires some careful consideration and balance. Most people have ideas about what they want for the next generations but don’t see why they should plan ahead. Procrastination and the influence of opinions from others are the two biggest reasons used as a reason not to address this sometimes difficult and emotional topic.

Why should you think about succession planning now?

It’s natural for benefactors to want to give and feel a sense of responsibility towards their loved ones. As a result, they want to provide for them when they’re no longer around. There are many ways of achieving this, such as helping their children buy their first home, kick-starting a business, or paying for their grandchildren’s education. Leaving your life’s savings or property is another way.

Providing for your loved ones

Security is a principal concern for most. Families wish to ensure that their wealth benefits their family members so that their successors can enjoy a good standard of living, are protected against emergencies and have a launchpad from which to make the most of their talents and ambitions.

A security that provides opportunities

Passing on an inheritance can also be about opportunity. Some benefactors want to ensure their loved ones have the financial security and freedom they need to be happy. For example, enjoying the freedom of a career choice without the hindrance of worrying about paying for the mortgage or their children’s education each month is appealing.

Philanthropy

Philanthropy can also play a part in estate planning. Many of us have causes and charities that we are passionate about and may wish to leave a part of our estates to support.

Minimising Estate Taxes

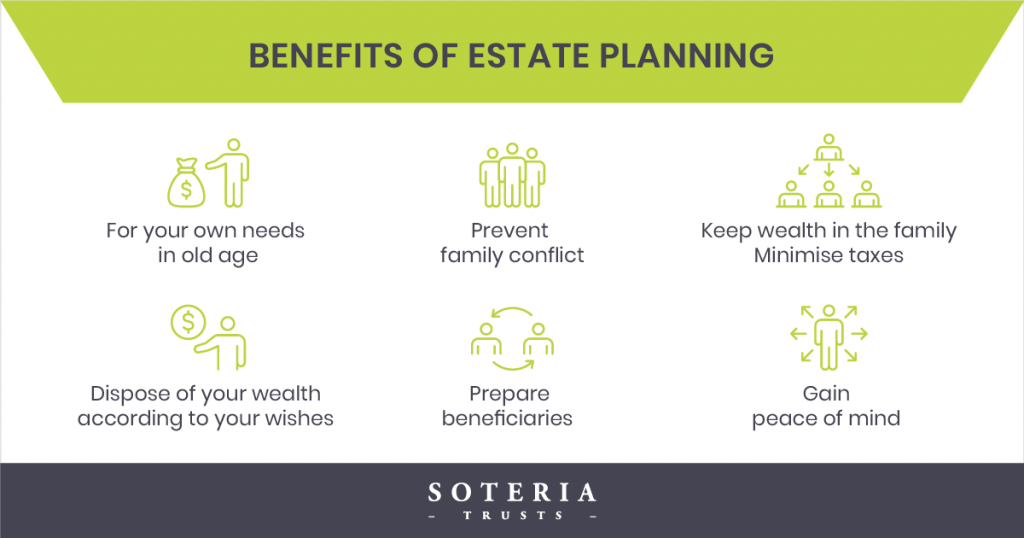

Tax is perhaps the most explicit reason for wanting to discuss IHT planning. Without prudent planning, an IHT bill can be a large proportion of your estate. It’s not uncommon for benefactors to want to provide not only for the next generation but for generations to come. They want to ensure a lasting legacy is passed on, along with plans and instructions on how the assets should be put to good use.

Why do most people delay succession planning conversations and actual estate planning?

Of grave concern to some when discussing inheritance is family conflict. Recent research by Macmillan Cancer Support revealed that over 1 million UK families had a ‘serious family argument’ after the death of a loved one. Nearly 1 in 6 of those has led to a family break up, with relatives no longer speaking. In addition, family members will often have differing ideas about what is ‘fair’, which is why sometimes avoiding family conflict during one’s lifetime is a reason to delay.

For example, benefactors with a business may not wish to divide their business equally amongst their children if some have not shown an interest in or an aptitude for the company. Others may not wish to divide the business at all, as this may lead to its disintegration, and by extension, a breakdown of their legacy. The same could be said for a property.

Individuals can also be deterred from planning because of their own expectations. There may be the worry that beneficiaries will become complacent, unambitious, unfulfilled, and lazy in a world that gives them little incentive to work for themselves. Just as leaving a legacy is a motivating factor, it can also be a debilitating one. Families are often wary of the potential dissolution of their wealth, especially if there are concerns about the capabilities of the beneficiaries.

However, a central driving force for all of the above is a reluctance to consider one’s own mortality. As human beings, we are built with a survival instinct, which can get in the way of our ability to plan for our own death. The beneficiaries too may be reluctant to bring up the topic if they are concerned about the potential tax bill for fear of seeming too enthusiastic to take over.

How to talk to your family about estate planning

The main point to remember when preparing to discuss succession planning with your family is to be transparent about it. While the conversation may feel challenging to begin, it’s one of the most important and beneficial discussions you can have. Estate planning can be a complex and emotional topic of discussion. However, the estate planning conversation will give you peace of mind and put your loved ones at ease, understanding their responsibilities and how they can honor your legacy.

- Schedule a date and time for the conversation ahead.

Let everyone involved know what the subject of the discussion is. It’s good to choose a peaceful place, preferably at home, and a day that everyone can attend and schedule plenty of time for questions and discussions.

- Be open and honest with your family.

If you don’t have specific wishes for how your estate should be managed after your passing, simply communicate this and offer to listen to what your closest family or beneficiaries think about the matter. If you have your mind up already, openly say what your wishes and intentions are, who your executors and beneficiaries are and pass on your wishes to everyone present during the conversation.

- Be prepared: have instructions and documents ready.

It’s important that a trusted person has access to the necessary information to retrieve the Will, access assets, and other documents to make sure that when you pass away, they know what to do and where to find the documents. Communicate the details about and location of the below documents:

- Your Will

- Lasting Power of Attorney

- Social Security Number

- Your Insurance Policies

- Your account information for financial institutions

- Debts details (if any)

- Any other documents

Canada Life’s research from 2021 has found that 59% of UK adults don’t have a Will. The research also states that nearly 60% of parents don’t have a valid Will – meaning they either don’t have one at all or the Will they do have is out of date. Moreover, as part of estate planning in the UK is the Inheritance Tax – HMRC data shows that a typical IHT bill in 2017/18 was 197,000 GBP. The first instance can be avoided by reviewing or writing a new Will, and the latter by careful and advanced IHT planning. Avoiding family conflict and ensuring everyone is informed in the process – is priceless.

Planning a legacy and succession strategy can be a complex and delicate matter with no standard template for managing it. However, a specialist adviser can act as the conduit to get you started on a journey that sees you implement a robust and achievable succession plan.