What to do when someone dies in Hong Kong

When a friend or relative dies whilst abroad, each country has its own set of laws, customs, and procedures to follow, and it may not always be possible to make arrangements which you prefer. You may therefore be uncertain whom to contact and what to do. The following guide will help by describing the steps one has to take when someone dies in Hong Kong.

If you have any questions, it is best to contact your local Consulate to receive help. People from the UK can also contact the Foreign Commonwealth and Development Office in the UK via a 24-hour hotline at 0207 008 1500. Although this guide is mainly for people from the UK, the basic rules will for apply each Nationality, with some exceptions on what is needed in the home country concerned.

Reporting the death in Hong Kong

The below rules are for people who died of natural causes with no suspicious circumstances. If the death is suspicious, the process is normally dealt with by the Hong Kong police with the involvement of a coroner. If the death is of natural causes, a post-mortem is not normally required.

The death needs to be registered with the Hong Kong Births and Deaths registry at www.immd.gov.hk/eng/services/birth-death.registering_a_death.html, and you will need the deceased full name, date of birth and passport number. You would need to disclose if the person suffered from any infectious conditions.

You do not need to register the death with UK authorities, as the Hong Kong death certificate is in English and can be used in the UK for most purposes.

Next of Kin

In Hong Kong, the deceased’s next of kin will usually need to make the decision and practical arrangements, although the next of kin can appoint another person to act on their behalf. For the UK, there is no legal definition of next of kin, and if the deceased did not choose their next of kin and there is disagreement over who is the next of kin, this can cause severe delays. In Hong Kong, if the next of kin is not in Hong Kong, the local authorities will normally contact the relevant Consulate. Most consulates will try their best to help with this and will ask local police to pass on the sad news. The body will need to be formally identified by the next of kin.

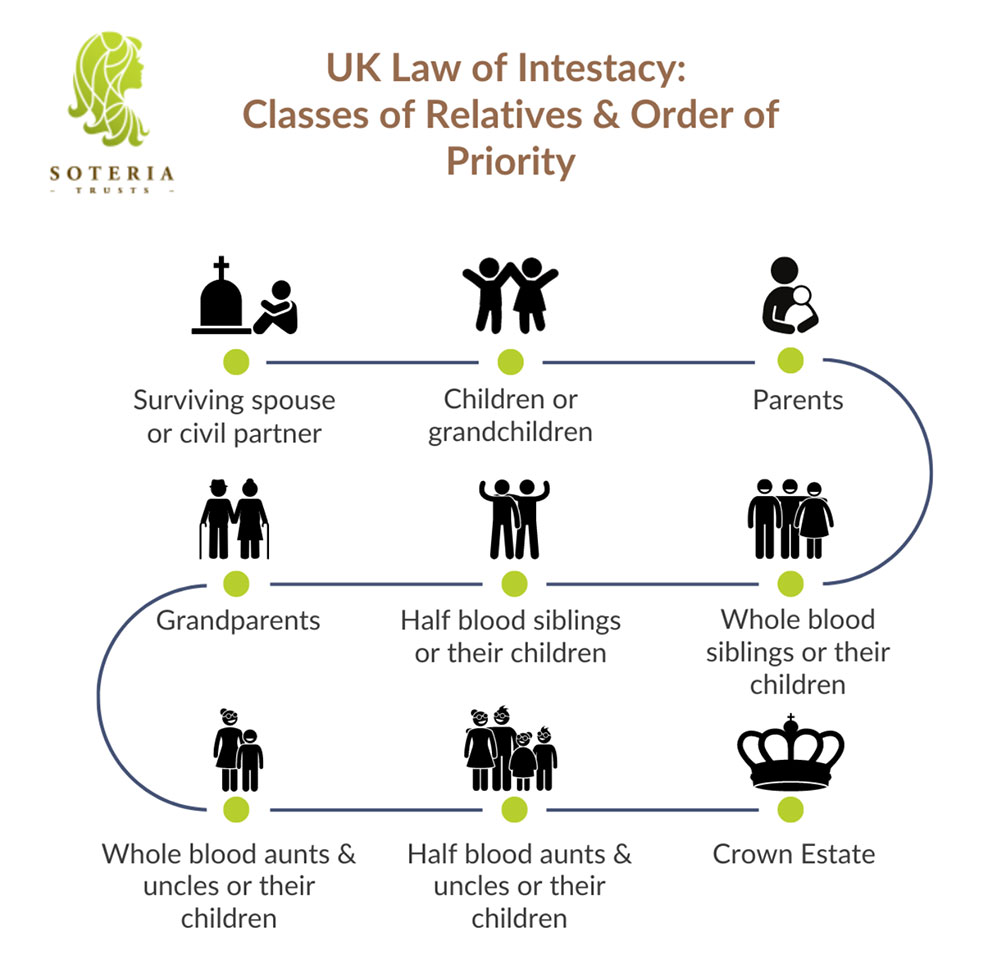

In Hong Kong, rule 21 of the non-contentious Probate rules regulates the order of next of kin as follows:

- Spouse

- Adult child

- Parent

- Adult sibling

Same-sex relationships are not recognized in Hong Kong, and partners may not be recognized as next of kin. The Hong Kong Police or coroner will ask to see the passport and proof of relationship with the deceased, such as a marriage certificate or birth certificate.

Insurance

Check if the deceased had relevant insurance, and if so, contact the insurance company as soon as possible. They may have a list of approved funeral directors and can help with the arrangements. If there is no insurance, it is up to the next of kin to organise the funeral arrangements, and they will be responsible for the costs. No help is normally provided by consulates.

Repatriation of the body

Repatriation is the process of bringing the body back to its home country. If the body is to be returned to the UK for burial or cremation, an international funeral director must be appointed. A post-mortem is likely to be required in the UK upon the arrival of the body.

The first thing to check here is whether the person had insurance that would cover this. If this is the case, report this to the relevant insurance company, and they will organise with International Funeral Directors to bring the body back. Many medical insurance plans have this coverage. If the person is not insured, then the next of kin will need to appoint the International Funeral Director and pay the costs of this themselves, which can be very expensive.

Repatriating the ashes

If the ashes are returned to the UK, you will need to hold these in a suitable vessel and agree with the airline concerned about whether this can be carried in the cabin. A death certificate and a certificate of cremation will need to be shown, and a standard customs form will need to be completed on return to the UK. You do not have to apply to the Hong Kong government for permission to take the ashes outside of Hong Kong.

You will need the deceased’s passport to transport the body, so make sure you do not cancel this before the body arrives in its home country.

Cremation in Hong Kong

If a funeral or cremation is to be held in Hong Kong, a funeral director will need to be appointed. These can normally be found online. Cremation in Hong Kong can take several weeks due to the lack of crematoriums in Hong Kong. To be cremated in Hong Kong, the next of kin will need to approach the Food and Hygiene Department at the Cemeteries and Crematoria Office with the certificate of the fact of death, the certificate of cremation and removal permit for the urn so that the ashes can be transported out of Hong Kong. This can be done via the local funeral parlour.

Mortuary facilities in Hong Kong

There is a morgue in every public hospital in Hong Kong and three public mortuaries based in Kwai Chung, Kennedy Town and Fu Shan. The place of death will determine which one the body is taken to. If the person died in a hospital, the body would remain in the hospital morgue until transferred to the funeral parlour.

Funeral costs in Hong Kong

The cost of a standard funeral includes undertakers fees, documents, a basic casket and standard religious service, but no tombstone or burial place is around HK$28,000.

The cost of cremation and transport of ashes back to Hong Kong is around HK$28,000- HK$30,000.

The cost of preparing and transporting a body to the UK, subject to the condition and weight of the body and flight cost at the time, is around HK$50,000 to HK$55,000.

The Hong Kong government will arrange a Pauper’s funeral if someone cannot pay for a funeral. Ashes are scattered at a designated place with no marking or burial.

Other matters to organise

Locate the latest Will and Testament and start to formulate a list of assets, to complete the process of probate and distribution of the Estate. Inform all the relevant companies concerned, such as banks, investment or trust providers and secure all possessions and assets of the deceased. Hopefully, the deceased will have a list of their current assets kept with the Will, or this may be on their computer if you have the password.

Professional Companies or Lawyers can be appointed to take you through this process.

Cancel the deceased passport to stop fraud by completing a D1 Form with HM Passport Office. Remember not to do this until the body has been repatriated if this is relevant.

Report to any insurance, investment or pension companies to either stop the annuity payments or inform them so that they can organise any death benefits or spousal benefits that may be available.

Notify any life Insurance companies to obtain the benefits.

You will need to notify the relevant Government departments in the UK to inform them of the death so that they can organise relevant matters from their side. This will allow them to provide any spousal benefits or cease any pension and welfare payments.

For a UK Domiciled person, an Inheritance Tax declaration will need to be completed.

Why a Will is an essential part of planning

If you do not have a valid Will in place upon death, then the Estate will be distributed according to local intestacy rules where the assets are based. This will take no account of your wishes, family circumstances or any taxation issues but will simply distribute the Estate according to set rules. This may not allow your spouse or children to benefit in full, and they could only receive a set portion of the Estate, with other family members or Governments benefitting from a large portion of your assets.

If you do not have a valid Will, it is strongly recommended that you put one in place as soon as possible. If you have a Will, it should be reviewed at regular intervals and should be rewritten on the death of any beneficiary or if any major changes happen, such as marriage, birth or divorce. We would, of course, be happy to help with this. Contact us via our website or email us here.