Why do you need an Estate Plan?

Are you familiar with estate planning? Whether this term is new to you or something that’s on your radar already, the reality is that it’s an important concept for anyone, especially if you have young children and other loved ones, as well as assets of a reasonable value. Creating an estate plan doesn’t have to be a stuffy and complicated endeavour; it can open up some meaningful opportunities for financial security and peace of mind. Read on to find out why estate planning could be an invaluable part of your future plans!

What is estate planning?

No one ever expects to die suddenly or face a long-term illness, but these things do happen. When they do, it’s crucial that your loved ones know what you want to happen to your estate, both your property and your money, and even yourself. That’s where an estate plan comes in.

An estate plan is a set of documents that clearly spell out your wishes in relation to the distribution of your estate in the event of your death or incapacity. It can include instructions for handling your property, naming someone to take care of your children, or making financial and healthcare decisions for you. It can extend to utilising certain pension strategies or setting up a trust fund. If you don’t have an estate plan, local laws overseen by people who don’t know you or what your intentions were will dictate how your estate is handled. If that does happen, there is a high probability that they won’t have the same ideas as you when it comes to distributing your assets the way you want.

So why not put yourself in control and make sure that your loved ones know exactly what you want? An estate plan is one of the most important documents you can ever create, and it’s never too late to start drafting one.

What consists of an estate plan?

An estate plan is made up of various legal documents that set forth how an individual’s wishes are to be carried out in the event of their death or incapacitation and might include some or all of the below, namely:

- Last Will & Testament

- Guardianship Nomination

- Powers of Attorneys

- Trust or Trusts

- Inheritance Tax Planning Solutions

These documents are brought together by an overarching strategy and an intention to carry out your wishes in relation to things such as:

- Managing financial assets

- Distributing property and possessions

- Caring for any minor children

- Outline funeral arrangements

- Provide for healthcare decisions

An estate plan for yourself

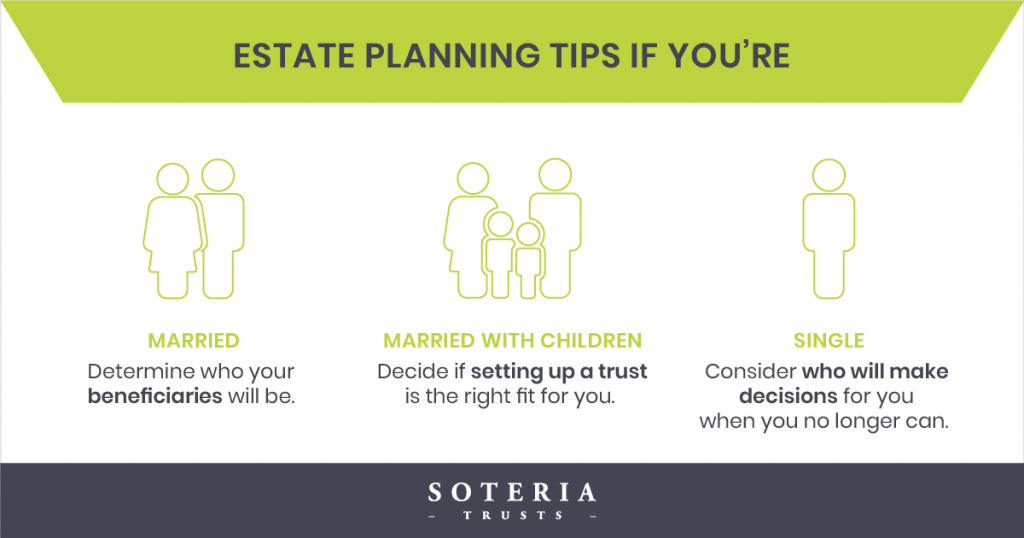

Estate planning is an important way to ensure that your estate, including possessions, money, and property, is taken care of according to the wishes you have outlined. As well as considering your financial well-being, an estate plan should also consider your health and welfare requirements.

It is often assumed that those closest to us will take over and make decisions about our finances and healthcare if we can no longer look after our affairs. However, in the event of incapacity, and the absence of the correct documents being in existence, financial institutions, such as your bank, have the power to freeze all your accounts, even if they are joint accounts, and prevent any access to funds.

You can name a trusted person in a Power of Attorney document that sets out how your personal finances, your business affairs, as well as any healthcare directives, are to be followed in a situation where you are deemed incapacitated, for example, due to an accident or illness, such as a stroke or dementia.

What happens if you don’t have an estate plan

Intestacy rules

If you do not have a Will and an estate plan, your estate will be handled according to state intestacy laws. This means that your estate will be divided among your next of kin based on a predetermined percentage which is set by the state. The percentages may vary from country to country, but generally, the spouse receives the largest percentage, followed by children and other relatives.

Family dispute

This can lead to costly legal battles between family members over the division of your estate. By creating an estate plan, you can specify who will get what when you die or become incapacitated.

High Inheritance Tax bill

There’s also the inheritance tax factor to consider. Proper planning, which should be implemented before it’s too late, will allow your family to significantly reduce any inheritance tax obligations. Solutions such as a Family Investment Company, a Qualifying Non-UK Pension or sheltering assets in a range of Trusts, , can effectively reduce the Inheritance Tax and other wealth taxes.

Your life is not in the right hands

In case of incapacity, if you don’t have the Lasting Powers of Attorney, your family will need to apply to the court to become a deputy. This can be a lengthy and expensive process and adds additional stress when you don’t need it. Mental and physical capacity can be lost at any time through an accident, so age alone shouldn’t be a determining factor.

How to get started with Estate Planning?

The best way to start estate planning is to consult a professional estate planner. Estate planners can help you with various tasks, from estate planning to asset management. They can also provide guidance on tax implications and inheritance laws.

If you don’t yet have an estate plan, it would be prudent to consult with an estate planning specialist as soon as possible. Doing so can ensure that your assets are distributed according to your wishes and that your loved ones are taken care of in the event of an untimely death or incapacity.

Questions to ask the estate planner

When consulting an estate planner, it is important to be prepared with questions to ensure your overall plan reflects your wishes. Before beginning the estate planning process, ask your planner about their experience and qualifications. Make sure they know the laws governing estate planning in your state or country. You should also ask them about alternative estate planning solutions that suit your situation.