Who will inherit if there is no will – the UK intestacy rules

When an individual passes away unexpectedly without a valid Will, their possessions and overall estate becomes subject to a set of rules known as the “rules of intestacy”. While these rules are set with logic to ensure the closest family members receive the bulk of the estate, it may not reflect one’s actual wishes. So, if you want your wishes for how your possessions are to be handled after death, make sure to have clear plans set out.

Why should you make a Will?

Making a will is the only way to ensure that your wishes will be met after you die.

It’s important to make sure your wishes are respected when you’re not around anymore. With a properly written will, there won’t be any doubt as to who benefits from your estate and can help avoid unnecessary disputes among loved ones after you’ve passed away. Additionally, wills ensure that the assets of your estate stay within the family for future generations while also allowing funeral preferences to be recorded too!

What happens when you die without a valid will?

In England and Wales, if someone dies without a will or their will is invalid, they have died ‘intestate’. This means that the state defines who will inherit, when they receive it, and in what proportions, regardless of any prior planning or arrangements that may have been made. In many cases, this can be complex and difficult for relatives. For example, only married or civil partners and some other close relatives can inherit under the rules of intestacy. The assets will be distributed after all debts, funeral and administration expenses, and any taxes due, have been paid.

What makes a Will invalid in the UK?

|

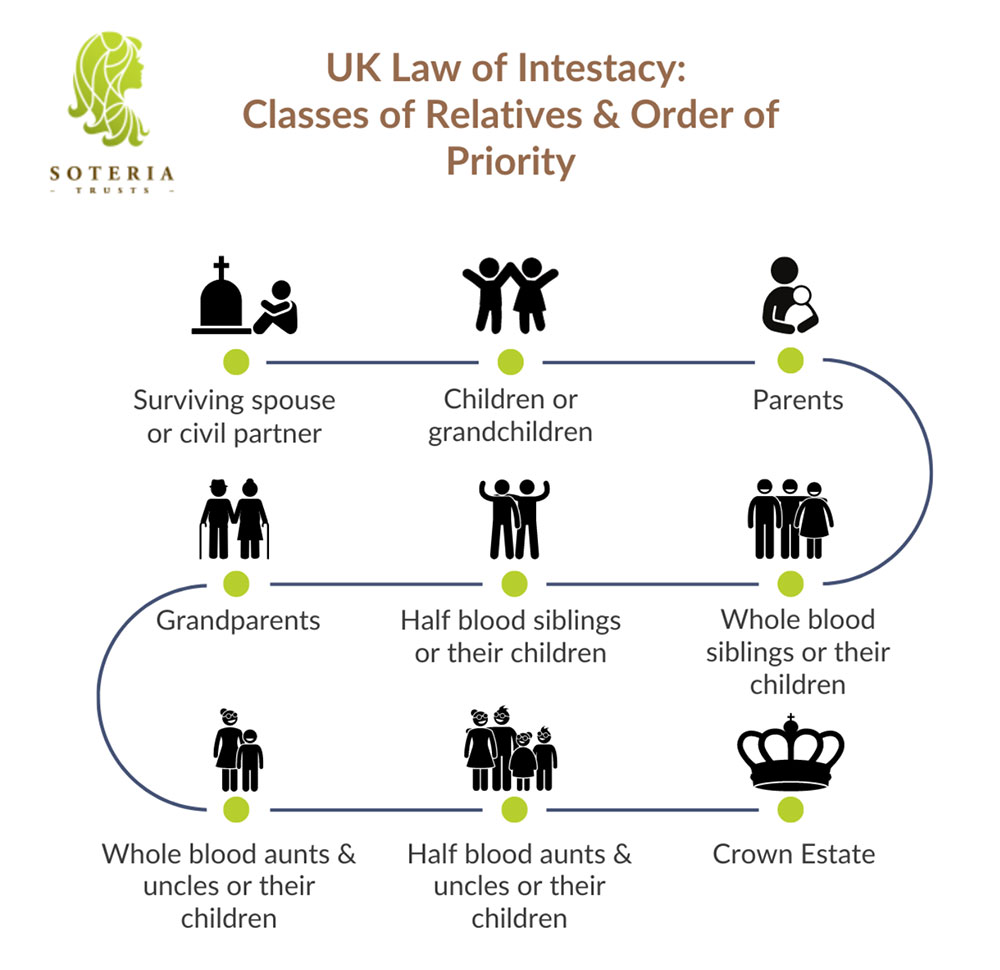

UK intestacy rules

UK Intestacy rules state that:

• If you’ve got a loving family, it’s likely they’ll be taken care of if something were to happen. Your spouse or civil partner will inherit your personal possessions as well as the first £270,000 and half of anything above this amount from your estate – with children inheriting the other half of this balance.

• If you are survived by a spouse or civil partner and don’t have any children, he or she is entitled to your entire estate, including any personal items of yours that are of great sentimental value.

• If you are survived by your children, but not a spouse or civil partner, then your children will inherit the whole of your estate equally among them.

• It’s essential for unmarried partners to take steps now and plan ahead. Without a will in place, your partner would legally have no right of inheritance from your estate – whether you’ve been together for years or have children together.

• If you have no spouse, civil partner or children, then other relatives such as parents, siblings, aunts and uncles, or nieces and nephews will inherit in a set order.

• If you have no surviving relatives who can inherit under intestacy rules, then your estate is passed to the Crown.

Writing a will is the most effective and affordable way to have your wishes legally recognized and carried out.

Regardless of your status in life, it is essential that you have a solid plan for the distribution of your estate after death. Writing a will gives you control over ensuring that the memory and legacy you leave behind reflects exactly how YOU want it to be remembered! Don’t fret if this responsibility has not yet been addressed – we are here to help explain what steps need to be taken towards achieving peace-of-mind through creating an appropriate estate plan.

Read more about our Will Writing Service and Estate Planning Services or contact us directly to get started!